- Opinion

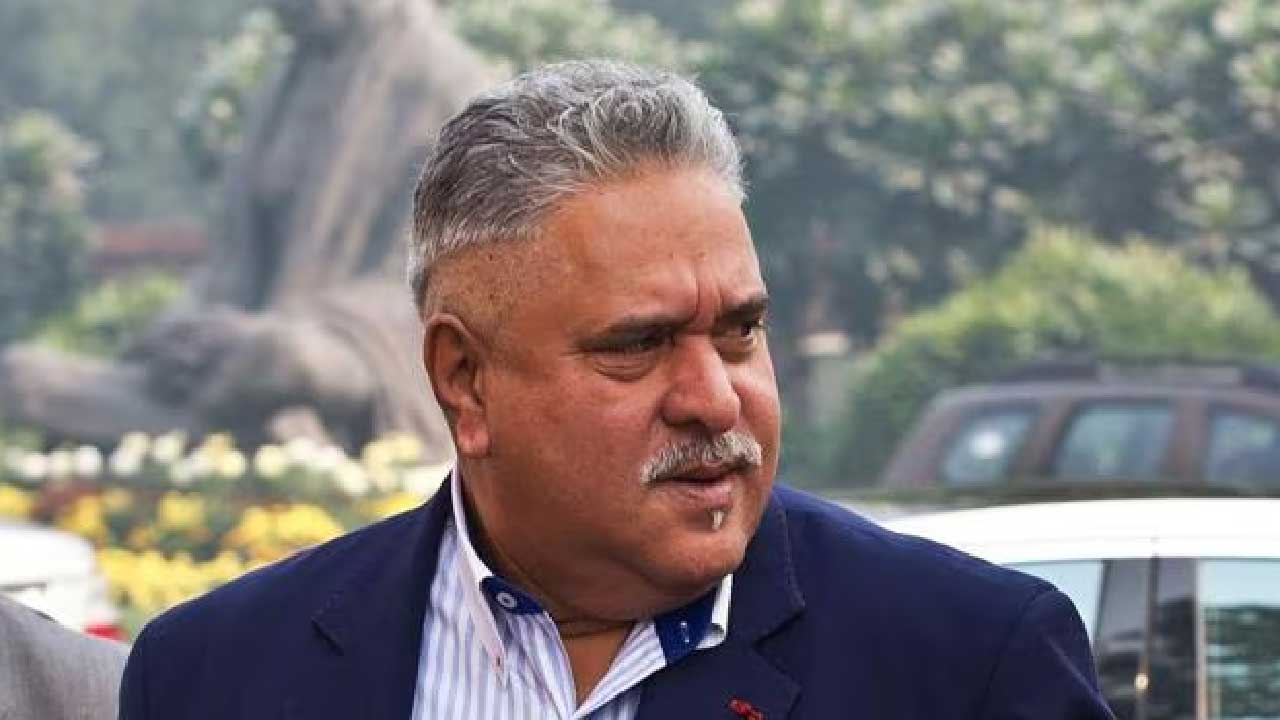

- Even after recovery of ₹14,000 Crore, Is Vijay Mallya Still a Villain?

Even after recovery of ₹14,000 Crore, Is Vijay Mallya Still a Villain?

A recent disclosure by Indian banking authorities has restarted debate over the continued prosecution of Vijay Mallya. According to official figures released last month, over ₹14,100 crore has been recovered from Mallya’s assets — nearly double the principal loan amount owed by Kingfisher Airlines at the time of its default.

This recovery includes proceeds from the sale of Mallya’s Indian and international properties, including his shares in United Breweries, luxurious real estate holdings, and other investments. The Enforcement Directorate revealed that the assets were attached and liquidated following required legal process, bringing significant relief to the consortium of banks involved in the original loan disbursement.

While the recovery was celebrated in financial circles, it has also raised an important question: If the money has been recovered, is there still a need for further action?

Prominent industrialist Harsh Goenka voiced this concern on social media, writing, “When banks have recovered more than they lent, why is Vijay Mallya still being painted as a villain?”

Mallya supporters argue that his case has been overly politicized, especially in the context of India’s broader crackdown on economic offenders. “It has shifted from a case of commercial failure to one of public spectacle,” said financial analyst Devansh Mehta. “We need to differentiate between willful defaulters and those who fell prey to economic conditions.”

Mallya’s defenders say that Kingfisher Airlines was a high-risk venture in a sector plagued by high taxes, unstable fuel prices, and a lack of supportive infrastructure. In a recent podcast that has gone viral, Mallya stated, “Every effort was made to repay. The airline failed, but I didn’t cheat anyone. The recovery proves that.”

Legal experts also giving warning against using Mallya’s case as a template for punitive action against entrepreneurs. “Economic policy should encourage risk-taking, not criminalize failure,” said Supreme Court lawyer Neelima Rao. She emphasized that the real issue should have been addressed through civil recovery rather than criminal proceedings.

On the other hand, some believe that recovering the amount doesn’t erase the alleged wrongdoing. “It’s not just about money; it’s about accountability,” said a senior official from the Ministry of Finance. The government maintains that the case is a test of India’s ability to uphold the rule of law and send a message to other defaulters.

Still, public sentiment seems to be shifting otherway. A recent opinion poll done by Business Insight showed that 42% of respondents believed Mallya’s continued prosecution was not needed given the financial recovery. Social media has also seen a surge of posts calling for closure.

Mallya has reiterated that he’s willing to return to India provided he receives a fair and impartial trial. “I’m not a fugitive. I’m a businessman who tried, failed, and repaid,” he stated in his latest appearance.

With the financial losses largely recouped, the spotlight now turns to whether India will pursue justice or closure — and whether Mallya will finally get to tell his side of the story in a courtroom rather than a courtroom of public opinion.

About The Author

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

-copy3.jpg)